When it comes to real estate investment, Cyprus stands out not only for its Mediterranean charm but also for its favorable tax environment. The island continues to attract investors, retirees, and digital nomads with some of the most competitive tax advantages in the EU.

Let’s break down why Cyprus remains a tax haven for property buyers in 2025.

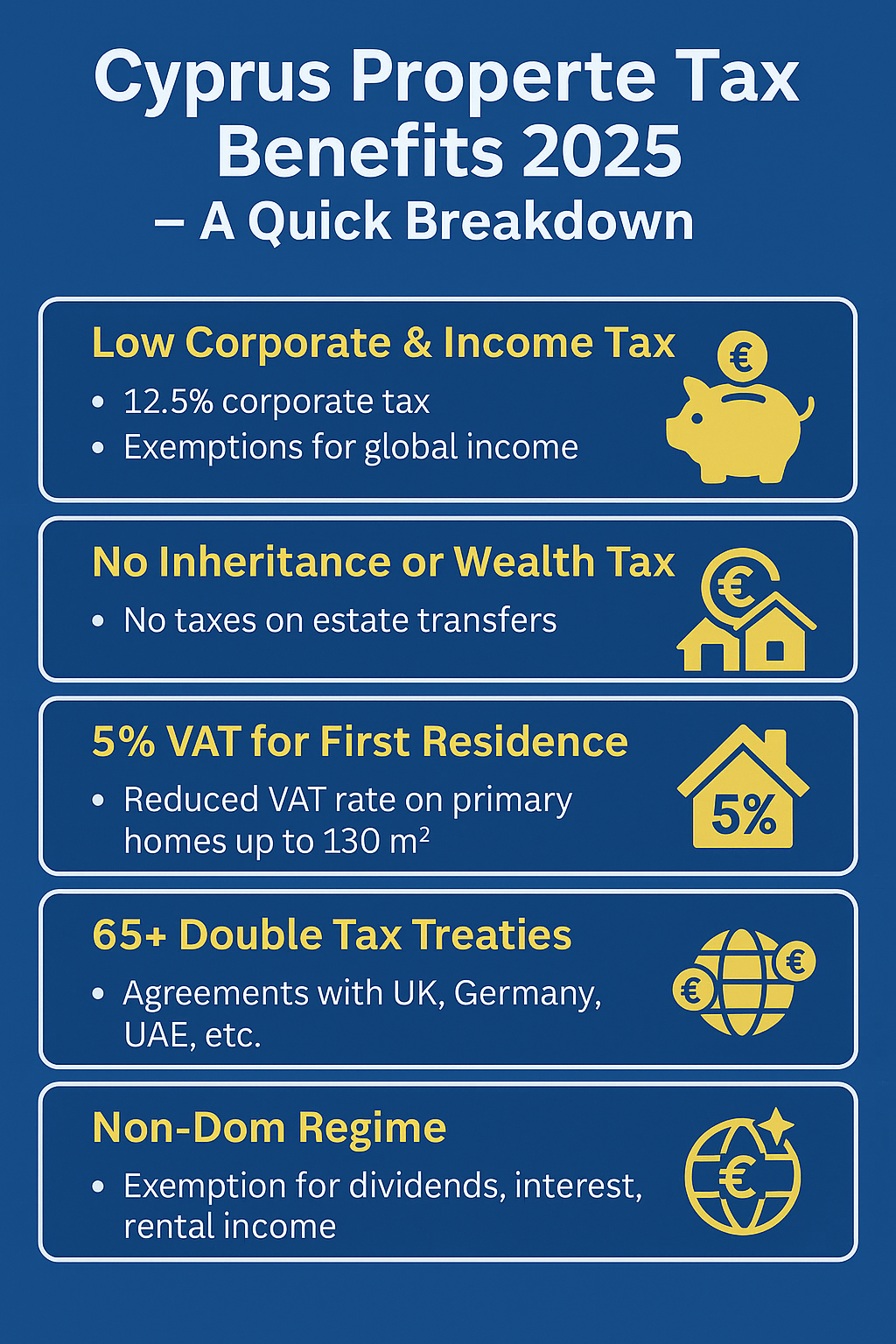

Low Corporate and Personal Tax Rates

Cyprus offers one of the lowest corporate tax rates in the European Union — just 12.5%.

This makes it ideal for entrepreneurs and investors looking to establish companies or manage rental income efficiently.

Individuals also benefit from progressive personal tax rates that exclude non-residents from paying tax on income earned abroad.

No Inheritance or Wealth Tax

Unlike many European countries, Cyprus does not impose inheritance or wealth taxes.

This means that your property and assets can be passed on to family members tax-free, preserving long-term generational wealth.

Capital Gains Tax (CGT) — Limited and Manageable

Cyprus applies a 12.5% capital gains tax only on profits from property sales in Cyprus.

However, there are key exemptions, such as:

The first sale of a primary residence (under certain limits)

Transfers between family members

Inherited property

For many investors, smart planning can minimize or eliminate CGT altogether.

VAT Incentives for Property Buyers

VAT on new properties in Cyprus is typically 19%, but buyers can benefit from a reduced 5% VAT rate when purchasing their first and primary residence — provided certain conditions are met.

This 5% rate applies up to 130 m² of the property, making modern apartments and smaller villas even more attractive.

Double Taxation Treaties

Cyprus has over 65 double taxation agreements (DTAs) with countries including the UK, Germany, Russia, China, and the UAE.

This ensures that you don’t pay tax twice on the same income — a major benefit for international investors and expats with multiple income sources.

Non-Domicile (Non-Dom) Tax Status

Foreign residents who become Cyprus tax residents but maintain non-domiciled status enjoy zero tax on dividends, interest, and rental income earned abroad.

This is one of the most attractive features for high-net-worth individuals relocating to Cyprus.

Final Thoughts

Cyprus combines lifestyle, investment, and financial efficiency like few places in Europe.

For anyone looking to buy property, retire, or relocate, the island’s tax regime makes ownership not just affordable — but genuinely rewarding.

Whether it’s for rental income, capital growth, or tax efficiency, Cyprus remains a smart choice for 2025 and beyond.